I made the switch this year from Amex’s normal Platinum card to the newish Charles Schwab Platinum card, mostly because I wanted to get another sign-up bonus. After Amex revamped the Platinum card and raised the standard bonus from 40k to 60k, the Schwab card followed suit, so when it came time to renew my Platinum card this year, I canceled it and opened the Schwab card instead. It seemed like an even trade, since the Schwab card has all the same benefits – the only downside is that it doesn’t offer referral bonuses… although my wife was the only person who ever used my referral link, so I don’t see that as a great loss.

Otherwise, the Schwab Platinum is identical to the normal one, down to the look and feel of the card, the welcome packet, and the benefits… save for two special enhancements for Schwab customers. The first really only benefits rich people – if you have $250k/$1M with Schwab, you get $50/$200 off your annual fee. If you aren’t sitting on that kind of wealth, you pay full price like anyone else. The second benefit is “Invest with Rewards,” which enables you to convert points to cash in your Schwab investment account at rate of 1 point to 1.25 cents.

When I originally signed up for the Schwab Amex, I didn’t really think much of the points-to-cash conversion, since I generally feel like my points are worth more than 1.25 cents apiece. However, gaming out various travel scenarios and comparing the utility of this feature against other cards, it turns out that it can really work out in your favor.

For a quick recap, here’s how it works. When you add the Schwab Platinum to your Amex online account, you’ll see an “Invest with Rewards” option under the normal “Explore Rewards” button:

Clicking that will take you to a page with some general info about the program:

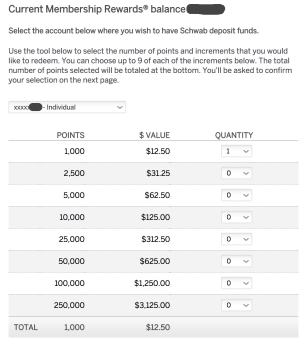

And once you enter some basic card info, you’ll get to select how many points you want to transfer to your Schwab account (in a fairly convoluted manner, I have to say):

That’s basically it. I didn’t end up making the transfer, but I went through all the steps before writing this post, mostly to confirm that my entire Membership Rewards balance would be eligible and that Amex wouldn’t limit it to the points I earned with this specific card.

So let’s think about this. If Amex points are worth 1.25 cents in cash, right off the bat they become a lot more useful for strategic travel redemptions. I’m thinking along the lines of using Chase Sapphire points for cheap hotel stays or short-haul flights in situations where you don’t want to pay cash. Flexibility-wise, Amex points are even better, because they’re as good as cash – you aren’t locked into a specific travel portal in order to get the 1.25/1.5-cent redemption value offered by Chase. (Chase points can be redeemed for cash too, but only at a one cent per point value.)

When the Sapphire Reserve came out, a lot of hay was made over the fact that if you combined the Freedom Unlimited and the Sapphire Reserve, you could guarantee yourself at least 2.25% cash back toward travel on every transaction (because the Freedom Unlimited earns 1.5 points per dollar, which works out to 2.25 cents toward travel when transferred to the Sapphire Reserve). However, Amex one-ups this if you add in the new Blue for Business card, which earns 2 points per dollar on all transactions up to $50k per year. That means that the Blue/Schwab combo gets you a minimum of 2.5% cash back period – not just for travel and not just through one specific portal.

2.5% back on everything is a fantastic return. The only other comparable card is the Alliant Visa Signature, which offers 3% cash back the first year and 2.5% each year thereafter. Otherwise, the closest would be the new Bank of America Premium Rewards card, which earns 1.5% or more depending on how much you bank with BofA. However, in order to get the maximum return (2.625%), you’d need to have over $100k on deposit with them. Any less, and you’re better off with Amex.

And, that’s just the return on everyday spending. Leveraging Amex’s entire card portfolio and the attendant bonus categories can really juice your overall cash-back returns.

- Airfare and hotels booked through Amex: 6.25%

- Groceries: up to 6% if you use a card with an annual fee; 3.75% otherwise

- Gas: 3.75%

- Everything else: 2.5%

(Quick aside that I’m of course ignoring the Platinum’s high annual fee here. To me, the card justifies its fee in other ways, so I’m not factoring the fee into these calculations. If you simply want cash back, you’re probably best off with a straight 2% cash back no-fee card or the Alliant Visa.)

This is important to me, because I find Amex points to be substantially easier to earn than Chase, just due to the sign-up bonuses available – and especially in the age of 5/24. If you’re maximizing your Freedom and Ink 5x categories with Chase, you’re going to do pretty well, but there are just so damn many Amex cards, I think it’s way easier to build up a six-figure balance in a short period of time. Plus, Amex is more generous with incremental bonuses (such as the 5000-point Amazon Prime renewal offer) and referral bonuses. So, given that Chase points are harder for me to earn, I’d rather save them for aspirational redemptions via unique partners like Korean Air than using them at $0.015 for dink-and-dunk flights or hotel rooms.

Amex has always offered such a vastly inferior value proposition ($0.01 for flights and $0.007 for hotels) that I’ve never considered redeeming Membership Rewards points through their travel portal. However, with this Schwab wrinkle, they become almost as valuable as Sapphire Reserve points, giving me a new option for low-value redemptions that can take some pressure off of my Chase balance. Staying within the world of travel, it’s also really important to consider that low cost carriers don’t always show up in the banks’ booking engines. If you’re looking for a flight around Europe and you want to book through Chase, you’re going to have to redeem your Sapphire Reserve points for flights on legacy carriers that are often 2-3x the cost of what you can find on Norwegian.

It’s an even bigger deal when you look at transatlantic flights. For instance, I’m brainstorming a trip with Justine next year to Venice, and I’m thinking about starting the trip in Rome. You can’t fly direct to Rome from San Francisco, but Norwegian operates direct flights from Oakland. That means that I could transfer 85,000 points to Delta in order to connect via Amsterdam or Paris, with 10 hours in a flat bed and 2 hours in Euro-business glorified economy seats… or I could pay cash to fly direct in Norwegian’s premium cabin, which isn’t as nice as business but is nicer than premium economy on Delta, Air France, or KLM.

Those Norwegian flights go for $700 – $850, so let’s imagine that I need to spend $1700 for two tickets. That means I’d have to transfer 136,000 points to cover the charges. That’s 68,000 points per person, or a substantial discount off of what you’d have to pay in Delta miles. The experiences aren’t totally equivalent, since business class on a normal airline is substantially better than Norwegian. However, considering a direct flight vs having to connect (especially given the shit-tastic quality of intra-Europe business class) does bring the two options closer in line with each other. It also means I have way more flexibility planning the trip and don’t need to worry about finding saver availability.

Consider also that if I pay for the Norwegian flights with my Platinum card, I’ll earn 8500 points, bringing the total per person down to 63,750 points. That’s roughly equivalent to what I’d have to spend if I transferred points to Flying Blue (assuming I do so before Flying Blue self-fucks their program with an iron rod), although in this scenario, I’d also avoid paying $250-$300 per person in fuel surcharges.

The Schwab Platinum card isn’t the only Amex card to offer interesting redemption options for Membership Rewards points, by the way. The Business Platinum does have the compelling benefit of offering a 35% rebate on pay-with-points travel redemptions, but there are some catches. First, of course, you’re locked into Amex’s travel portal. But even if you assume you’d be able to book those Norwegian flights, you’d then have to have 170,000 points in your account in order to purchase the flights, and you’d have to wait for the 59,500 points to be credited back to you. Ultimately you’d pay right around 55,000 points per ticket, which isn’t even that much less than the Schwab option described above.

Low-cost premium cabins like Norwegian’s and the new seats supposedly coming to WOW Air will be increasingly important to me as more and more opportunities for aspirational redemptions dry up. Just look what’s happening with Flying Blue and British Airways Executive Club… Chart-based redemptions aren’t going away immediately, but the process is definitely picking up steam. All along I have said that once chartpocalypse finally comes, I’ll turn my focus to working cash back cards in order to afford the cost difference between economy and premium on low-cost carriers. Now I’m realizing how lucrative the Schwab Amex can be in this scenario.

In the end, I’m not going to forsake transferring points to frequent flyer programs or anything – I’m just happy that I more or less stumbled into a new redemption option for my points that can make a lot of sense in certain cases.

(Finally, in case you aren’t familiar with Schwab, it’s actually really easy to get an account with them. It isn’t like Morgan Stanley or Ameriprise that are mostly seeking high net worth individuals… A Schwab brokerage account is free, and the Schwab Investor Checking is a fantastic checking account in its own right. I originally looked at Schwab as a result of the Amex partnership, but I’d continue to use them as my primary bank even without Amex.)

Support your windbag!

This site is ad-free, because I think ads are ugly. That's why I rely on readers for support! If only one person per year gives me $5, then I'll have $5 more per year. Everyone wins!

$5.00

Very interesting! So you convert points to dollars in your brokerage account, then transfer those dollars to checking? I’ve been a happy Schwab customer for years – go Schwab!

LikeLike

> “Staying within the world of travel, it’s also really important to consider that low cost carriers don’t always show up in the banks’ booking engines. If you’re looking for a flight around Europe and you want to book through Chase, you’re going to have to redeem your Sapphire Reserve points for flights on legacy carriers that are often 2-3x the cost of what you can find on Norwegian.”

I haven’t tried it yet, but it’s my understanding that there’s at least a good chance that if you call up the UR line, give them a date and a flight number for a Norwegian flight, and say you would like to use UR to book said flight, they will likely be able to do it. I’ll be trying this next fall, for a LAX->Rome flight. I agree, if that doesn’t work, you definitely are better off paying cash for transatlantic flights and saving the UR for other things. (I still love UR because you can often redeem them at 1.5cpp for *non*-chain hotels, including, sometimes, tiny b&bs, which I prefer staying at when I can. Got a stay at a fantastic 10-room b&b in Santa Fe on UR last year, for instance.)

LikeLiked by 1 person

I thought of this combo earlier this year when the Blue Business Plus came out. I’ve been using it every since. 2.5% return on normal spend is AMAZING!!

LikeLike

Amex biz Plat offers as good/better value. Get 1.5x on purchases >$5K. Then, get 35% rebate when booking travel with points. I still have the 50% rebate version (until 6/18) so it’s even better. Couple with PRG 2x at grocery or Blue Biz that gets 2x up to $50K, and get equivalent to 4% for travel. I’ve found the 50% rebate particularly useful since it makes purchase of cheap (relatively speaking) biz seats competitive with points awards. The huge advantage is you are paying cash and effectively can pick any seat at any time and not desperately search for rare-as-hen’s-teeth premium awards. Also earn status and mileage credit. Plus Biz Plat only has $450 AF.

Thanks for reminding me about the Schwab Plat – think it’s the only flavor I haven’t signed up for. I signed up for the Ameriprise Gold – 25K MRs for $1K spend and no AF first year. Don’t need to be Ameriprise client.

LikeLike

What he said. Only flies in the ointment are (a) I’m now down to 35% on Business rebate; and (b) have hit the $50K for the Blue for Business (older version). But all the other stuff, flexibility, and those MR points tickets at Amex Travel are usually another 5% lower.

LikeLike

subscribe

LikeLike

When you take into account the annual fee of 550 on the plat and the cap of 50,000 dollars spend a year on the blue the best return you can actually get is 1.4%.

LikeLike

That’s true. As I mentioned in the article, I personally find the fee justifiable in other ways, so I didn’t purposely include it in my math. If you’re only interested in 2.5% cash back, there are other cards that are better suited to that.

LikeLike

Why don’t you use USBank Altitude Reserve with Samsung Pay and get 4.5% towards travel on all purchases? Effective annual fee is $75

LikeLike

It’s a good card for sure, and it’s on my list to get this year. I don’t know if I want to be too locked into US Bank’s travel portal, and mobile wallet is still a pretty small portion of my overall spending, even when I go out of my way to use it (as I am this quarter with the Chase Freedom bonus).

LikeLike

Us bank portal is the same as Chase or Citi, sometimes even cheaper, sometimes not. But it’s not as easy to use as Chase/Citi. There is a cancellation fee, which i don’t like.

Freedom is limited to $1500 each, so i just MS them. You should try Samsung pay, which works everywhere, many places online or apps now accept Android pay or Visa checkout (works with both SP and AP). I don’t even carry a wallet many times now.

LikeLike

Don’t forget the B of A cards that give you 2.65 points per $USD on any spend as long as you have Preferred Rewards Platinum status which you get with a large investment with the bank. But if you have a decent sized IRA you can just move it there (and get a bonus for the moving too). The Premium version of the card gets you more points for travel categories.

LikeLike